Western Australian Budget 2024-25 reflections

First reflections on the WA 2024-25 Budget

This is the first WA budget with Premier Roger Cook and Treasurer Rita Saffioti at the helm, and it’s a strong debut.

The budget measures laid down by Treasurer Saffioti this afternoon lean on the continued strength and resilience of the WA economy, combining cost of living relief with measures to grow the state’s housing stock, and drive forward with industry development, infrastructure, diversification, and decarbonisation initiatives.

WA finances

WA is posting a $3.2bn surplus for 2023-24, which is half a billion lower than the Mid-Year forecast of $3.7bn, but not surprising given the drop in iron prices (from US$140/tonne in mid-December 2023 to $100/tonne in early April 2024).

The budget projects lower surpluses of $2.6bn and $2.4bn for the next two years, but with these predicated on iron ore prices that are assumed to drop to US$71 over the forward estimates, this leaves a fair amount of headroom for larger surpluses.

Cost of living measures

The budget commits $762m towards cost-of-living support, primarily through a $400 electricity credit for households and small businesses at a cost of $492m. Among other cost of living support measures, the WA government has provided student assistance of $150-$250 per child, free public transport for school kids, and has lifted the value of the Regional Pensioner Travel Card by $100 to $675. According to the Treasury budget papers, the combined changes to tariffs, fees and charges will save the typical household around $124 in 2024-25.

If there is one criticism of these measures, it would be in way the cost-of-living reliefs have been targeted.

The electricity credit goes to all households or businesses with power bills, regardless of their incomes. Families on the lowest incomes have been hit the hardest from the cumulative impact of rising food, housing, and transport costs. It will take time for the state’s most financially vulnerable families to recover, and the government needs to ensure there are appropriate targeted measures to support their recovery.

Price and wages growth

I thought the 3.5 per cent price inflation forecast for 2023-24 in last year’s budget was ambitious, but fair play to Treasury officials, they weren’t too far off, with the estimated 2023-24 outturn for CPI expected to be 4 per cent.

Price inflation is expected to hit 3 per cent next year and 2.5 per cent over the longer term. Wages have grown more strongly than expected too, up a quarter of a point to an estimated 4.25 per cent in 2023-24, dropping to 3 per cent over the forward estimates.

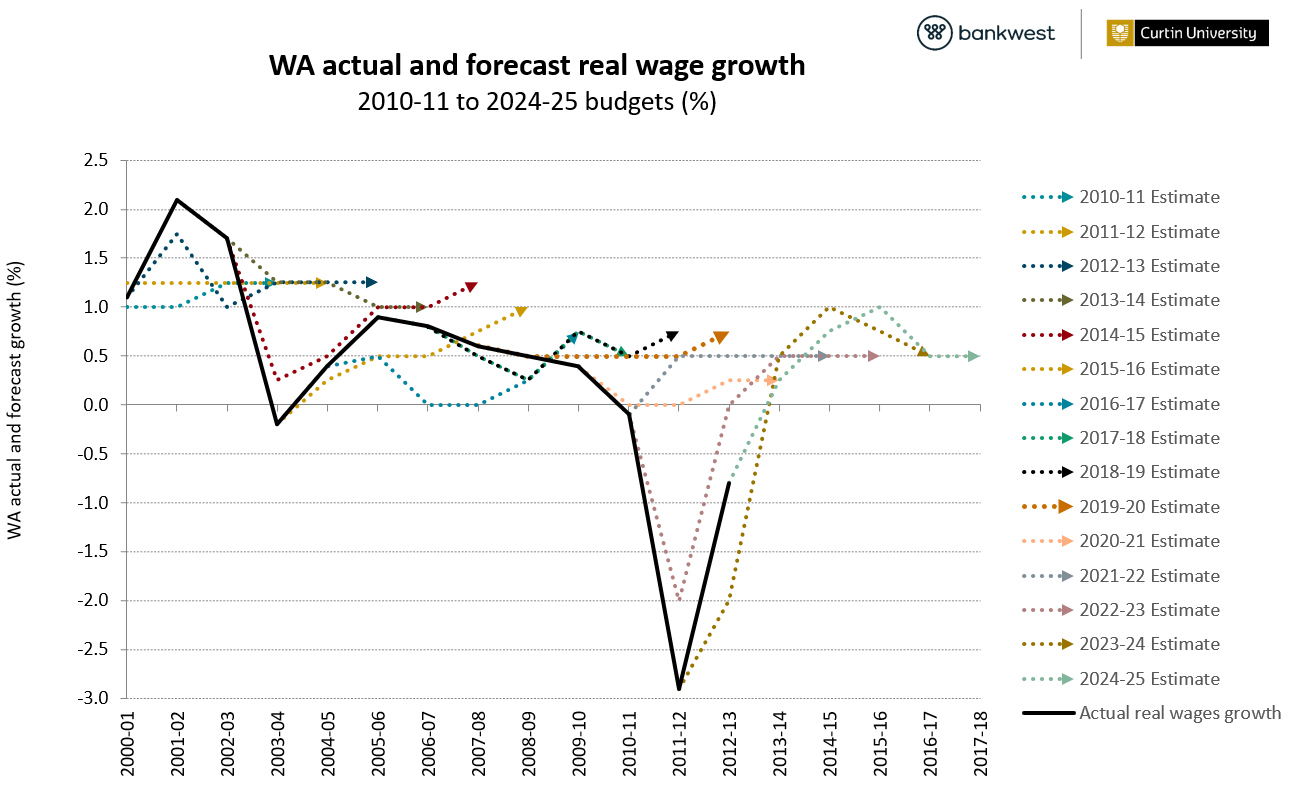

This signals a return to modest real wage growth of 0.25 per cent in 2023-24, rising to 1 per cent by the middle of 2026 before reverting to a fairly cautious 0.5 per cent over the long-term.

But before we celebrate too much, it’s worth remembering how hard families have been hit. The cumulative impact of rising prices and negative real wage growth over at least the past two and a half years has eroded the purchasing power of wages.

By my calculations, it will take four years of real wage growth at 1 per cent to take the real value of wages back to where they were before the pandemic hit in 2019.

Housing supply and support for the construction sector

The need for urgency in resolving the housing crisis has been recognised by the Premier and Treasurer through a series of budget measures that are designed to lift the productive capacity of WA’s construction sector and address the challenges of delivering new housing stock. These include a $1.1bn package of additional investment to boost housing supply, including $400m towards the Social and Affordable housing fund, $82m in stamp duty relief, $50m towards essential government worker housing and a $35m boost for regional land supply.

The budget also includes grants worth $5,000 to incentivise property owners to convert vacant housing stock to long-term rentals. Policies to promote more efficient utilisation of existing housing stock makes sense. With a commitment of $5m towards the vacant grants program, the government expects this to add 1,000 new dwellings to the rental stock.

The budget also includes an $85m support package intended to grow the state’s construction workforce through wage subsidies, and support for employment and training costs. The intention is laudable, but WA’s construction businesses have long struggled to retain apprentices and trainees against the lure of substantially higher wages for workers who transition to the resources sector, especially when mining businesses are doing so well.

Economic activity

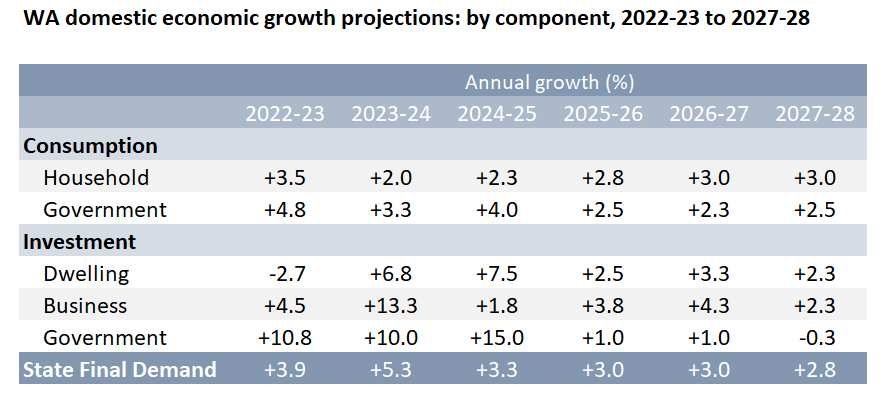

Domestic economic activity in Western Australia (State Final Demand) is projected to grow by 5.25 per cent in 2023-24, before dropping to 3 per cent over the next three years. It’s worth noting that this year’s strong domestic economic growth has been investment-led, driven by large resources projects like the Scarborough LNG project.

However, with many major projects coming to an end, the pipeline of new investment projects is narrowing. Household spending will need to pick up the slack if the state is to meet its economic growth target, and this depends on lower price inflation, real wages growth and greater consumer confidence. Household saving rates have fallen well below the long-term average of 5.75 per cent, but they’re starting to recover from the end of 2023, so there’s some hope that the positive growth forecasts will eventuate.

Diversification and decarbonisation

The scale of the government’s asset investment program is impressive, with $12.1bn committed next year and $42.4bn over the next four years on a number of major initiatives. These include $4.3bn towards decarbonisation of the South West Interconnected System, $1.8bn on an economic diversification program including $500m towards a Strategic Industries Fund, $373m to develop the state’s port infrastructure, and a $165m adventure tourism package.

Over the past two budgets I’ve felt the government is really hitting its straps in putting flesh on the bones of the 2019 Diversify WA strategy. The stronger orientation towards clean energy and decarbonisation initiatives is to be welcomed, given how quickly the state will need to move to meet its net zero emissions goal by 2050.

Employment

The Premier made much of the fact that 300,000 more people are employed in WA now compared to when the government came into power in 2017, and 210,000 more since 2021.

These numbers sound impressive, but you need 40,000 new jobs every year just to keep pace with population growth. WA’s population grew by 94,000 over the year to September 2023, and is projected to hit 3m in the next year. With working age population growth of around 2 per cent expected over the next year, the forecast for employment growth of 1.75 per cent in 2024-25 is a little below par. I think it’s revealing that unemployment rates are projected to rise from 4 per cent to 4.75 per cent and participation rates to fall half a percentage point over the next four years.

Professor Alan Duncan is Director of the Bankwest Curtin Economics Centre.