Reflections on the Western Australian 2023-24 Budget

The strength of the Western Australian economy buys WA Premier Mark McGowan a lot of degrees of freedom to combine cost-of-living relief with measures to grow the state’s housing stock, and drive forward with industrial development, infrastructure, diversification, and decarbonisation initiatives.

Economic growth is projected to hit 4.25 per cent in 2022-23 and remain above 2 per cent the year after – a strong result by any measure.

WA is posting a healthy $4.2bn surplus which is coincidentally the same in dollar terms as the Federal government’s surplus. But Federal budget returns to deficit from 2023-24 while WA is projecting surpluses in excess of $2.3bn for the next four years. So there are fewer constraints on Mark McGowan than Jim Chalmers in the budget measures that he can bring in.

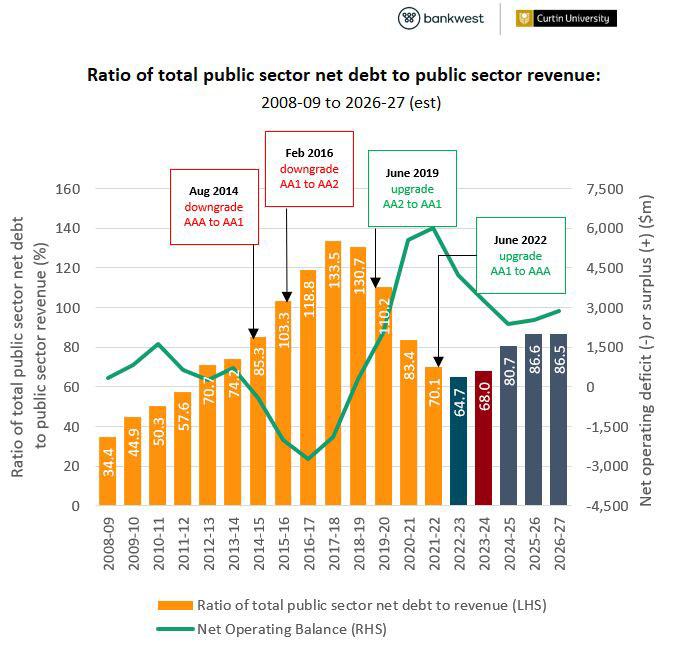

Public sector net debt has fallen to $27.9bn in 2022-23 – the lowest level of debt as a share of revenues in a decade. Net debt is expected to rise to $35.9bn by 2026-27, but that’s to be expected because of the lower operating surpluses combined with a strong infrastructure investment program.

The budget featured some welcome measures to alleviate cost-of-living pressures – primarily through $400 electricity credit with extra support for people on Energy Assistance Payments, and household fees and charges up by 2.4 per cent (below current inflation), Hardship Utilities Grant Scheme payments up by 10 per cent.

The delivery of 4,000 more social housing dwellings, stamp duty concessions, support for construction projects and the $48m package to expand the construction sector workforce all reflect well on the government’s priorities. But the short-term challenge of completing 27,500 houses currently under construction remains significant.

There wasn’t much immediate relief in the budget for the rising rents that many in Perth and the regions have been facing. Commonwealth Rent Assistance (CRA) was raised in the federal budget, but this only adds between $11 and $15 per week to CRA support – a fraction of the rent increases that people in private rentals have borne (up 15 per cent in the last year alone).

There are vulnerabilities to the budget assumptions for price inflation and wages growth.

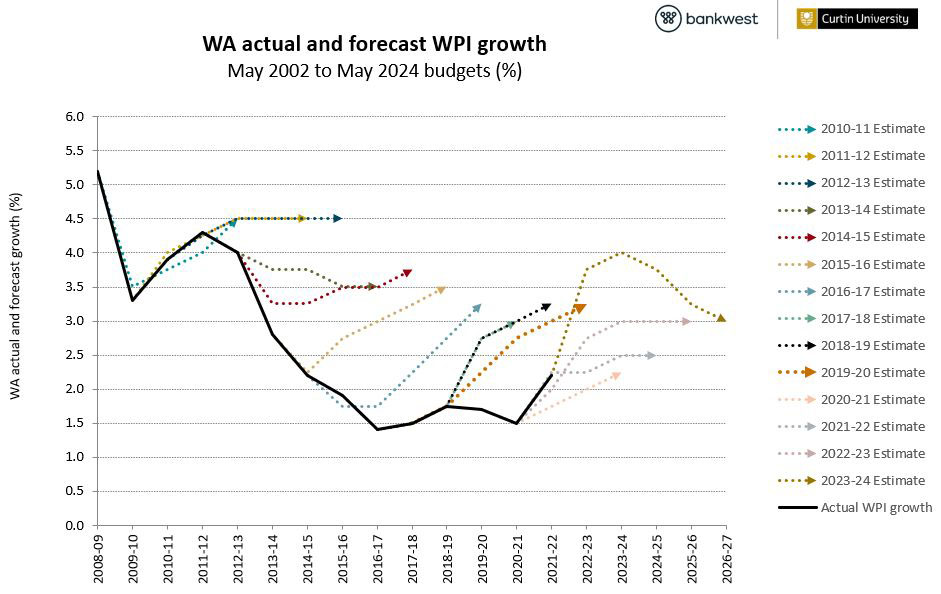

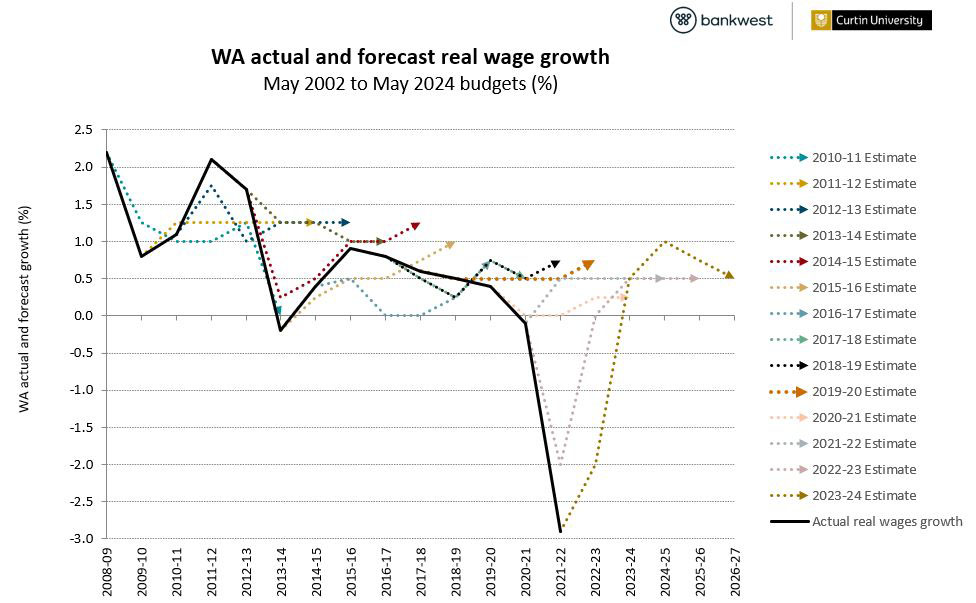

The history of past budgets shows that wage growth projections are typically over-optimistic – the last time annual wages growth in WA averaged more than 3 per cent was a decade ago.

The projected return to real wages growth of 0.5 per cent from next year is ambitious and predicated on a big drop in CPI from 5.75 per cent to 3.5 per cent over the next year. That’s a bit of a hostage to fortune when there are no real levers at the state government’s disposal to target this reduction – this seems to be more driven by the hope that the RBA will do its job in controlling inflation.

Professor Alan Duncan

Director

Bankwest Curtin Economics Centre